The Lamen

Apple Car: Inception and Demise

The Apple Car was touted as a disruptor, the future of autonomous driving, the luxury EV of the future. Such is the case no more.

Image: Generated with Bing AI

Apple co-founder Steve Jobs dabbled with the idea of building an “Apple Car” as early as 2008, Nest Labs founder and ex-Apple exec Tony Fadell once revealed. “We had a couple walks, and this was in 2008, about if we were to build a car, what would we build? What would a dashboard be? What would seats be? How would you fuel or power it?” he told a Bloomberg interviewer.

But the idea clearly wasn’t taken as seriously. “At the end, it was always like, we’re so busy, we’re so constrained… it’d be great to do it, but we can’t,” Fadell said quoting Jobs. He instead chose to focus more on the iPhone, a decision most won’t question, but maybe the idea of an all-electric car never got rubbed off the board.

Reports of Apple working on cars first surfaced in early 2015, with WSJ suggesting that the company has several hundred employees working on an all-electric vehicle — internally called Project “Titan” — that resembles a minivan in its current iteration.

Chief executive Tim Cook reportedly signed off on the project nearly a year prior, assigning ex-Ford engineer and then Apple exec Steve Zadesky a team of a thousand employees to lead the project. As usual with Apple, details remained sparse, but the pitch involved a premium, fully self-driving car to primarily compete with Tesla, a company that it could’ve purchased at one point.

With plans to get a car on roads as early as 2019, it began poaching employees from traditional automakers in efforts to jump-start its auto engineering division.

Company staff reportedly visited contract manufacturers that could build one for Apple while it provided the software, with Magna Steyr (having built cars for Mercedes and BMW in the past) being among them. Tim Cook even tossed around the idea of buying British supercar company McLaren at one point.

Rumors of manufacturing partnerships with Korean battery-builder LG, and others have since floated around. In 2021, Korean automaker Hyundai confirmed that it was in early talks to develop a car with Apple, with reports suggesting that it could be manufactured at a Kia assembly plant in Georgia. But no such partnership came to fruition.

The seductive idea of cars driven by computers can be traced back decades, and a chorus of hype generated by startups in recent years made it seem quite achievable.

In 2017, Tim Cook first elaborated on the company’s secret plans of a long-rumored car project:

“We’re focusing on autonomous systems. And clearly, one purpose of autonomous systems are self-driving cars,” he said in a Bloomberg interview. “And we sort of see it as the mother of all AI projects. It’s probably one of the most difficult AI projects actually to work on and so autonomy is something that’s incredibly exciting for us, but we’ll see where it goes.

The New York Times reported that John Ive, Apple’s chief design officer, designed a car that “would look like a European minivan such as the Fiat Multipla 600, which has a half-dozen windows and a curving roof. It had no steering wheel and would be controlled using Apple’s virtual assistant, Siri.”

Apple quietly tested its tech in white Lexus models bearing an array of sensors on their roofs, test driving frequently around California — Wired reported that Apple had driven over 45,000 miles in 2023 using its self-driving technology.

But even after years of research and burning through over $10 billion, Apple seemed no close to launching a car. Multiple heads and key staff departed since the project’s inception, and constantly changing plans meant that the project never moved ahead full steam.

By the time Apple wrapped up its car project, Bloomberg reported that it had already drastically scaled down its ambition — development transitioning from a full self-driving car to a more conventional, driver-assisted automated EV, similar to what competitors like Tesla and General Motors offered.

Apple’s initial hubris was well justified. It had done something for smartphones and wearables no one else could match. Believing that it could achieve the same in transport didn’t seem like a stretch.

But driverless EVs are complex. Apple set out to crack a technology that even seasoned automakers continue to struggle with. Investors, at the same time, are tightening the reins on battery-powered, driverless vehicles. Companies like Rivian, exclusively selling pure EVs, are struggling to find new customers — and almost no one has been able to put an affordable plug-in car on the roads.

The EV adoption curve is jagged, a result of stagnating sales as early adoption is nearing its end. Companies that ended up receiving insane valuations are quickly slimming plans, and legacy automakers are proceeding with caution. Ford paused its $12 billion investment in a new EV factory, Honda and GM canceled their plans to jointly develop a slate of affordable plug-in cars, and several more are placing their bets on hybrids.

Even at $100,000, an Apple car would generate measly profits compared to iPhones. It would also arrive in an industry that is, unlike smartphones, heavily regulated and unionized, and almost entirely dominated by Tesla.

Now almost a decade later, Apple has put its plans of all-electric, autonomous vehicles to rest in favor of pursuing the buzzword of Silicon Valley: generative AI.

Being on the sidelines for the better part of the year that saw OpenAI’s ChatGPT soar and force Google into the generative AI race, Apple has some catching up to do. Cook was extremely vocal about the company’s generative AI efforts at its last quarterly earnings call:

“As we look ahead, we will continue to invest in these and other technologies that will shape the future. That includes artificial intelligence, where we continue to spend a tremendous amount of time and effort, and we’re excited to share the details of our ongoing work in that space later this year.”

The iPhone maker has reportedly acquired 21 AI startups since the beginning of 2017, according to FT, and recently unveiled new MacBooks with M3 chips, calling them the “world’s best consumer laptop for AI.”

While pleasing for investors, restructuring and moving the remaining 2,000-person team to work on generative AI will likely involve layoffs, resulting in workplace havoc for several employees.

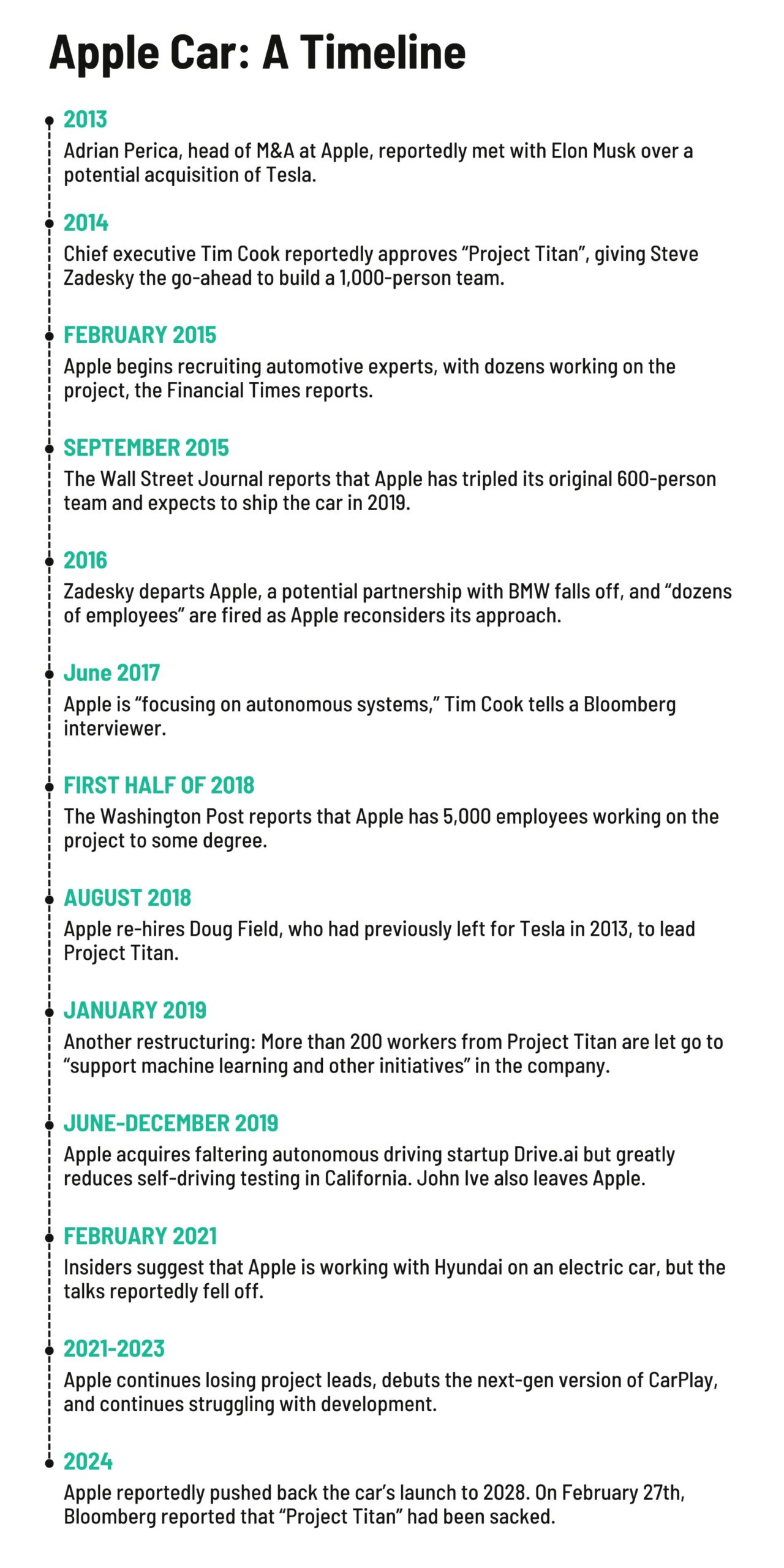

A timeline of Apple’s “Project Titan” until it was sacked. Data: The Verge, Techcrunch, WSJ, Financial Times | Graphic: The Lamen

This stepback might in part be a response to the threat of Chinese EVs, sold at absurdly low prices even when incurring tens of thousands of dollars in losses just to disrupt market share. In the final quarter of 2023, the Shenzhen-based company BYD outsold Tesla for the first time, owing to low-cost plug-in cars that could flood roads across Europe and the U.S. in the near future.

But the failure shines light upon Apple’s failure to innovate in recent years, something that the company has continually claimed as one of its guiding principles despite almost exclusively following what others started. While Apple has mulled over the venture for years, the industry has repeatedly come across the pitfalls of autonomous vehicles and high-end EVs, and the market is shifting rapidly with hardly any space for accommodation.

But not everyone has resigned their plans to break into the auto industry. Sony’s joint venture with Honda involves building the all-electric prototype called Afeela, due to ship sometime in 2026. While several details remain concealed, the car will leverage Sony’s expertise in entertainment to offer a unique proposition — a PlayStation on wheels.

Chinese smartphone manufacturers are particularly eager: Xiaomi unveiled its first EV last year, accompanied by a boastful goal of becoming one of the world’s top 5 automakers in the next 15-20 years. Huawei and Chery Automobile partnered on an electric car unveiled last November under the brand Luxeed. Even Baidu is working on one.

The auto industry isn’t devoid of challenges, and even the Chinese face many. But for a company with near-endless cash reserves and access to some of the greatest engineering minds to throw years of research and billions of dollars in investments on the back burner indicates that breaking through requires more than just cushty builds and all-leather interiors.